COVID-19 Financial Market Update

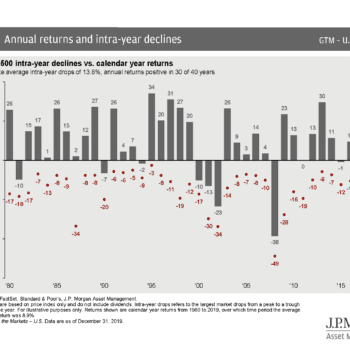

Volatility is the word when you consider the Covid-19 Financial Market. The coronavirus (COVID-19) scare is escalating and a logical question has moved to the forefront: Is this downswing different? Is coronavirus going to permanently bring down markets in a way those past crises could not? The historic litany of disease outbreaks, armed conflict flashpoints, political game-changers, and other alarms all generated fear of the unknown. However, the nature of markets allows them to still