Portfolio Management

5 Estate Tax Mitigation Techniques You Should Consider

The Tax Cuts and Jobs Act In 2017, The Tax Cuts and Jobs Act doubled the amount that someone could pass to their heirs without incurring Federal estate tax. As a result, many families have enjoyed relief from the federal estate tax. In 2023, an individual can pass just under $13 million ($26 million for a couple) to their heirs without getting hit by the 40% federal estate tax. There is an important caveat note,

A Word on Small-Cap Value Stocks

Chief Investment Officer Andy Popenfoose shares thoughts on small-cap value stocks. He reviews the wild ride they have had year-to-date and their role in your portfolio.

Celebrate Your Resolve

Recent numbers are now in, with good news to share. With some financial analysts describing a “gravity-defying” “monster rally” across major market indices, most disciplined investors have been richly rewarded for sticking with their appropriate investment allocations. Even had quarterly and year-to-date numbers not shown improvement, we would have advised you to remain invested as planned anyway. The same can be said for whatever the rest of the year has in store. We know markets

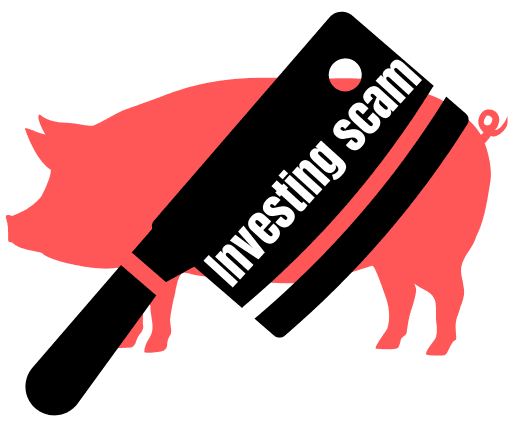

Protect your Investible Assets from Pig Butchering

What is it? A new cyber scam. In our last installment, Cyber Security and Your Digital Assets – SYM Financial Advisors –, we outlined how to build an effective cyber security plan. We hope that you are making headway on securing those digital assets. Part of building a strong cyber security plan requires being informed of the ever-evolving criminal scams that attempt to rob you of your hard-earned assets. Personal vigilance is still one of

Ways to Maximize Your Executive Compensation and Benefits

In this episode of Executive Decisions Podcast, host Sarah Delahanty, a certified financial planner, talks about how her firm, SYM Financial Advisors, helps executives understand and maximize their executive compensation and benefits. She emphasizes the importance of diversifying risks and making sure clients have a game plan for the year, including determining what may be beneficial to exercise relating to stock options, selling or retaining restricted stock units, participating in employee stock purchase plans, and