Wealth management for medical professionals requires a different planning approach. Medical professionals typically earn less income in early earning cycles compared to the traditional American worker. When their earnings balloon, they often do so quickly and then stabilize at a high base. Fortunately, you can compensate for the dramatic drop in a healthcare professional’s salary. All it takes is wise planning during the earning years.

A Smart Approach to Wealth Management for Medical Professionals

We have several tips for doctors, dentists, and other healthcare professionals that can help them with their financial planning.

1. Choosing Your Retirement Tax Bracket

Within a few years after entering the workforce, many healthcare professionals travel right to the top tax bracket. However, they will not be in that bracket forever. With wise planning can avoid returning to it in the retirement years.

When the high-wage earning years end, most physicians don’t expect to receive a pension. Instead, they rely on distributions from various retirement and non-retirement portfolios to pay ongoing living expenses. When these assets are properly structured, well-advised retired physicians can dictate their tax bracket. This can be done by choosing between retirement and nonretirement account distributions to fund their lifestyle.

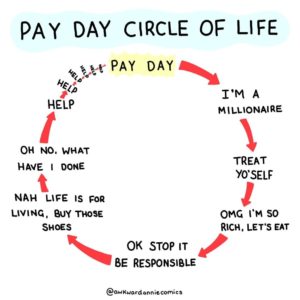

2. Expenses and Lifestyle

SYM recommends constraining your lifestyle expenses from the outset. This discipline should reduce the nest egg required for retirement, and may also leave you with more cash each year to apply toward that nest egg.

Using round numbers, let’s consider a hypothetical healthcare professional earning an annual income of $400,000. That person might well pay $120,000 in taxes, leaving $280,000 for living. If that person should adopt a $280,000 living habit, he or she would require a nest egg of around $5 million to comfortably retire at a similar lifestyle. However, this leaves little free cash flow from which to save. Even saving $10,000 to $20,000 annually does not go far when the savings goal is $5 million.

However, if the same person is able to save $80,000 per year for 25 years and earn 7% on those funds, at the end of that time they may accomplish a nest egg of roughly $5 million from which to draw in retirement. By making this savings commitment, the person’s lifestyle and expectations will cost less, having lived on approximately $200,000 per year, a retirement lifestyle that could be funded with a roughly $4 million nest egg. While investment returns will vary and there is never a guarantee of the success of this or any other investment strategy, you can see how sizing one’s cost of living with savings in mind is a good first step to put most people on the path to retirement.

3. Blended Investments

We recommend saving early and often in retirement accounts, even if this means paying down debts more slowly. As your income grows, our recommended savings rate of 20% may eventually provide more funds than you can allowably contribute to your retirement accounts and you may choose to invest the rest in taxable investments.

Using a blend of tax-deferred and taxable investments is what typically allows you to choose the tax bracket in which you will pay taxes after retirement. This is accomplished each year by intentionally withdrawing more or less from tax-deferred accounts. Tax brackets should go down in retirement, and income saved pre-tax in high tax bracket years will be taxed at much lower rates when it is withdrawn.

TIP: Don’t make the mistake of directly funding a Roth 401(k) in your high wage-earning years. During residency or training, when income and tax rates are very low, by all means, fund a Roth IRA or 401(k). But in your high wage-earning years, if you pay the highest tax rate now with the idea of saving taxes at a later date, you will likely be worse off. Even if taxes rise in the future, you personally might drop a couple of tax brackets to a lower rate as long as you have structured your assets to support it.

4. Life Insurance Strategies

Assuming you are on a path towards financial freedom in retirement, most people will eventually out-earn their need for life insurance. After all, when you have enough wealth on which to retire without a pension and live out the rest of your life, then by definition you no longer need life insurance to cover an earnings loss. For that reason, we favor structuring life insurance strategy on low-cost term life. Many healthcare professionals could sufficiently protect their families with a 20-year term insurance policy (which means your premium will stay level across the 20 years). Choose a quality company and your coverage should be there if an untimely tragedy occurs.

5. Disability Insurance Strategies

Most employers keep employees well-encouraged to continue working at their fullest potential and recommend only a modest amount of disability insurance, usually no more than $150,000 to $200,000 per year of coverage. If possible, pay these premiums with after-tax dollars. This may ensure that any payments received in the future would not be considered taxable income.

6. 401(k) Contributions and Salary Deferral

If your practice has a 401(k) plan, highly-compensated employees may run up against contribution limits enforced by IRS nondiscrimination testing requirements. The smaller your practice, the more likely you are to face this particular savings issue.

If IRS testing limits your ability to defer, it is possible to layer your plan structure in a way that allows high wage earners to still maximize their tax deferral opportunities. One such vehicle is a cash balance plan that uses different testing metrics. If the demographics are right, certain practices can capture $100,000 per year or more of pre-tax dollars for each practice owner.

TIP: Are you consulting for the Social Security Administration? Drug or implant manufacturers? Paid speaking engagements? If you earn 1099 income, we recommend using it to enhance your savings strategies. When strategizing wealth management for medical professionals, circumstances vary. However, we commonly can fund SEP IRAs with 20% of net earnings from such activities.

7. Tax Planning Strategies

Taxes are a success problem. Ask any American and most would choose high incomes with high taxes over low incomes with low taxes. That said, your financial advisor works with you to be sure you take every opportunity to save in a tax-advantaged manner. Strive to maximize your contributions to tax-deferred retirement plans. Consider placing additional dollars in “backdoor” Roth IRAs. And, when investing in both retirement and taxable accounts, we recommend holding the least income-tax efficient assets in the retirement accounts, and the most income-tax-efficient assets in the taxable accounts.

8. Asset Protection

SYM advises healthcare professionals to ensure their practice is carrying sufficient malpractice insurance with strong liability insurance coverage, including a large, additional umbrella liability policy. Litigation often follows wealth, and the Dr. before your name may seem like it comes with its own “Sue Me” target to wear on your back.

Best practices are highly dependent on state laws, but we often suggest placing ownership of most assets in the name of a non-physician spouse. When both spouses are healthcare professionals, we recommend holding assets in the name of whoever has less risk to their specialty. Sometimes joint tenancy remains the best answer and at other times, special trusts. Set up and review your asset protection plan early, because transferring assets while under a lawsuit can be misinterpreted as an acknowledgment of guilt.

For additional questions on wealth management for medical professionals or to add any of these discussion items to your SYM meeting agenda, contact your advisor or call 800-888-7968.