Employer-Sponsored

Retirement Plans

Employer-Sponsored Retirement Plans.

Explore the possibilities for your business.

Schedule a 30-minute discussion with a plan specialist.

We take care of the plan.

We take care of the sponsor.

We take care of the participant.

You are not in this alone.

We handle the burden of managing your benefit offering by interfacing with your other professional resources, educating your employees, and assuming fiduciary responsibility for your plan alongside you.

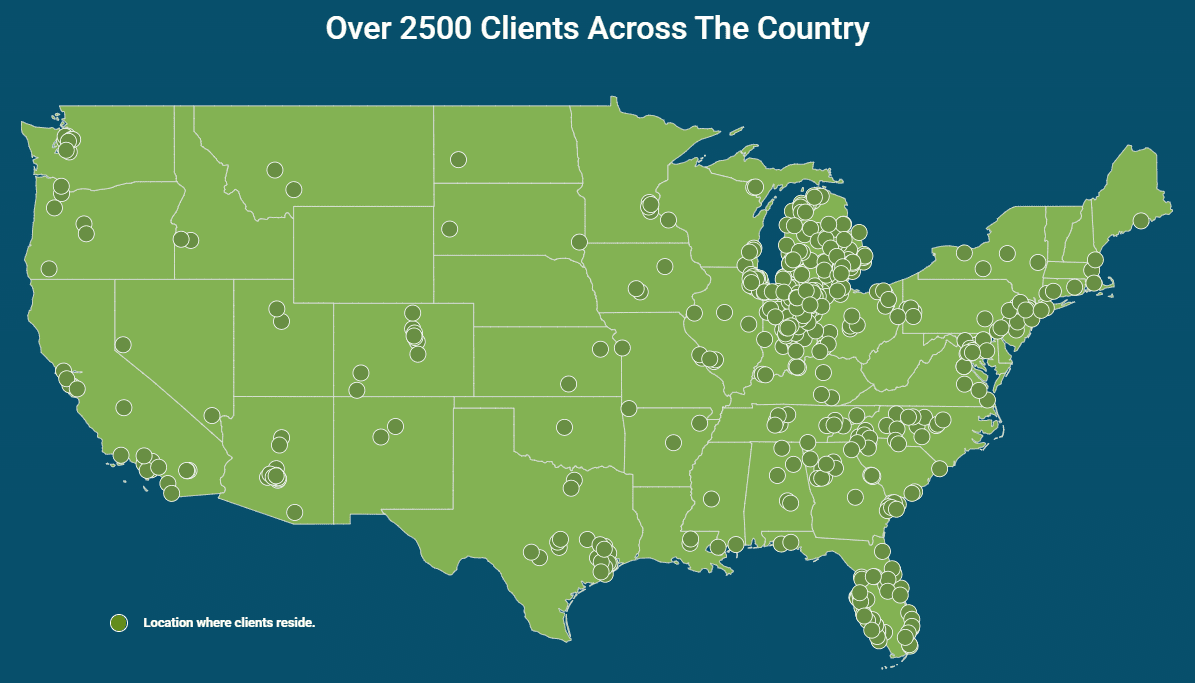

SYM Financial Advisors provides 401(k) and retirement plan consulting services to plan sponsors across the U.S.

Investment selection and implementation

Plan monitoring and management

Key collaborator with TPA, attorneys, CPAs, and compliance

Employee education

We’re Fiduciaries to You

As a business owner offering a 401(k) plan to your employees, you are held accountable for an in-depth level of knowledge that, for most, lies outside your area of expertise and familiarity. That’s where SYM comes in.

Smarty Pants

SYM has a long history of serving plan sponsors and participants. As an advisor to over 130 corporate clients and near 20,000 participants, we understand the rewards and challenges of offering a qualified plan.

Protecting Companies

It is our goal to provide a plan that will benefit your employees and maintain your profitability. As your advocate, we’re on the lookout for design, compliance, and administrative pitfalls.

Shepherding Participants

You want your employees to experience a rewarding retirement, and we want that too. We’ll offer one-on-one conversations to each of your plan participants to help them understand and work toward achieving their goals.

“How far will you go to protect and grow our employer-sponsored retirement plans?”

“We progress when we think more and better.” Plato

We take care of the plan. We take care of the sponsor. We take care of the participant. While this may not roll off the tongue as easily as some marketing phrases, it explains everything SYM does to service retirement plans.

To illustrate, a SYM client (a company) didn’t pass their year-end deferral testing. This testing is conducted by the Third Party Administrator (TPA) in order to assure compliance with all applicable discrimination guidelines. Not passing meant that a portion of the money employees thought they had saved in their 401(k) plan would have to be returned to them, resulting in lower than expected contributions that year...

The average advisory firm might have said “Okay, let the client know the results, then process the appropriate returns to the participants.” SYM’s Employer-Sponsored Retirement Plan team did not immediately accept the failing grade; instead, they took time to review the test and see if anything could be done.

In doing so, they recognized an opportunity for an alternate testing option not attempted by the company’s TPA. SYM gathered some additional data from the client, ran a preliminary test, and saw that the alternative method would pass.

The result? Fifteen employees did not receive an unwelcome check in the mail, refunding their 401(k) deferral dollars. Instead, they were allowed to keep all their contributions in the plan for the future, and the employer was saved paperwork and administration time. While not every testing scenario will end this way, in this case, putting together a team of people with a client focus, technical expertise, and inquisitive minds allowed SYM to serve a client uncommonly well.

Disclosure: The above scenario is for illustrative purposes only and is not intended to depict an actual client or circumstances. This material is not financial advice, an offer to sell, or a solicitation of an offer to purchase any security managed by SYM Financial Corporation (“SYM”). The opinions and assumptions expressed herein are those of SYM Financial Corporation (“SYM”) and are subject to change without notice. SYM is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about SYM including our investment strategies, fees, and objectives can be found in our ADV Part 2, which is available upon request.