Wealth Planning

A SYM Financial Core OfferingCustomized for Your Unique Situation

Your hobbies, your love for family, your sense of humor, your care, and your drive is what makes you unique. From tax and retirement planning to risk assessment and elder planning, SYM takes on the particulars of your unique financial picture.

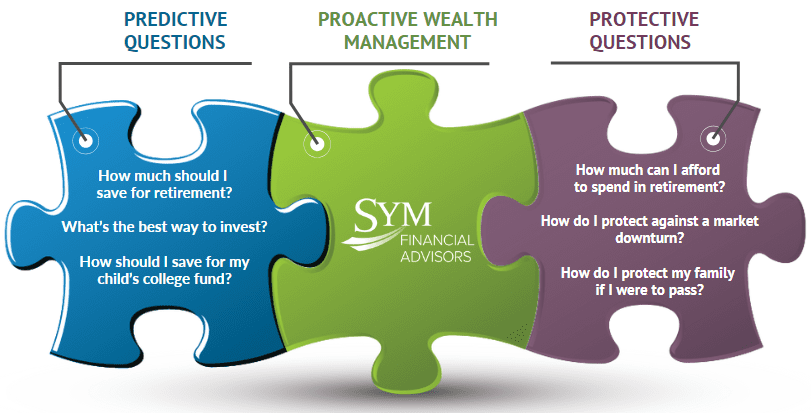

We ask the right questions with a holistic focus to build your wealth plan. We test assumptions and report the probability of your financial plan’s success. Our commission-free structure is designed for your best interest, because we want you as a client now and for decades to come.

What

When

- Tax Planning

- Estate Planning

- Risk Assessment

- Cash Flow Planning

- Retirement Planning

Retirement or job change

Marriage and growing a family

Divorce or loss of a loved one

Families and individuals seeking a plan

Advancing the Ball

Even beyond the scope of the assets we manage, we can collaborate with your other professional service providers and proactively work towards your best interests.

Whizzes At Work

We seek out knowledge of the various facets of your life, then construct and maintain a financial plan that encompasses it all. Our goal is to positively impact the lives of our clients and their families.

Looking Around Corners

Live your life, knowing your advisor is looking ahead. As your circumstances change and the world changes around you, know that your advisor isn’t forgetting about you.

Focused on Results

When your advisor knows you uncommonly well, you’ll feel the difference. SYM’s business model and people-centered culture seeks to make goal-based, comprehensive planning a breeze.

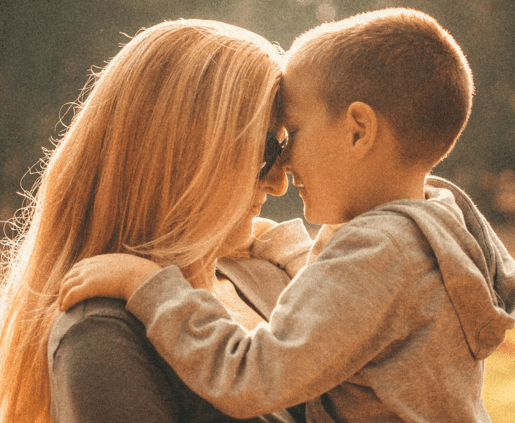

“How do I secure my child’s future?”

“We must not only give what we have; we must also give what we are.” – Desire Joseph Cardinal Mercier

Peace of mind can also be a financial goal. A common misconception of the financial planning industry is that firms like SYM work either with clients who are saving and investing for retirement, or clients who are already enjoying retirement. The fact is, all clients come with unique situations, goals, and objectives.

One couple, each in their 40s, approached a SYM advisor to discuss their estate and wealth planning needs. The husband and wife, Marcus and Lisa, were both working professionals with an eleven-year-old daughter, and Marcus had recently been diagnosed with a terminal disease.

The focus of the meeting was to plan for the future, most likely without him, and the appropriate use of the life insurance proceeds that would be received into trust.

Sadly, the husband succumbed to the disease, whereupon the wife chose to shift her focus from practicing medicine to being an at-home mother. SYM created a plan to invest and use the life insurance proceeds to supplement her income, which allowed her to work on a part-time basis and spend more time with her daughter. As time went on, Lisa would increase the number of hours she worked as her daughter became older and more self-sufficient.

This wealth planning strategy also included allocating part of the life insurance proceeds to pay for the child’s eventual college expenses. Twenty years have now passed. The daughter graduated from college without any debt and Lisa returned to work.

For Marcus and Lisa, SYM’s wealth management team became their partners through a time of transition and made an unbearable situation a little bit easier.

Disclosure: The above scenario is for illustrative purposes only and is not intended to depict an actual client or circumstances. This material is not financial advice, an offer to sell, or a solicitation of an offer to purchase any security managed by SYM Financial Corporation (“SYM”). The opinions and assumptions expressed herein are those of SYM Financial Corporation (“SYM”) and are subject to change without notice. SYM is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about SYM including our investment strategies, fees, and objectives can be found in our ADV Part 2, which is available upon request.